Key points of Malaysias income tax for individuals include. For FY 2021-22 and 2022-23 individual taxpayers will continue to choose between two tax regimes - the existing or old tax regime and.

Deemed notional rent in respect of unsold flats held as stock in trade applicable wef AY 2018-19.

. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. IMoney Income Tax Relief for YA 2018. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the income of any person accruing in or derived from Malaysia.

The GoBear Complete Guide to LHDN Income Tax Reliefs. There were no changes announced in the income tax slabs both for old and new tax regimes for FY 2022-23 in Union Budget 2022. Nonresidents are subject to withholding taxes on certain types of income.

Personal Income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective Year of Assessment 2020. Best Tax Saving Plans. Standard deduction was introduced for the salaried taxpayers under Section 16 of the Income Tax Act.

Tax rebate for self. Other income is taxed at a rate of 30. Simplified FAQs on TDS under section 194S of Income Tax Act The Finance Act 2022 had inserted a new section 194S to the Income-tax Act 1961 providing for deduction of tax at source TDS on transfer of a virtual digital asset VDA.

Income Tax Slab Rates for FY 2019-20 AY 2020-21. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. RinggitPlus Malaysia Personal Income Tax Guide 2020.

Malaysia follows a progressive tax rate from 0 to 28. If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged. LoanStreetmy 9 Things to know when Doing 2019 Income Tax E-Filing.

1961 is available to the individuals who have a yearly income up to Rs. CompareHero 7 Tax Exemptions in Malaysia to know about. Tax rebate for.

The CBDT or Central Board of Direct Taxes has announced the Finance Act 2018 wherein it has amended the Income Tax Acts Section 18. According to the budget released in 2019 there have been some changes in the structure of the tax slab in the interim budget 2019 the tax rebate of Rs. RinggitPlus Everything you should claim as Income Tax Relief.

A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. 12500 under Section 87A of IT Act.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. The income tax slabs and rates have been kept unchanged since financial year FY 2020-21.

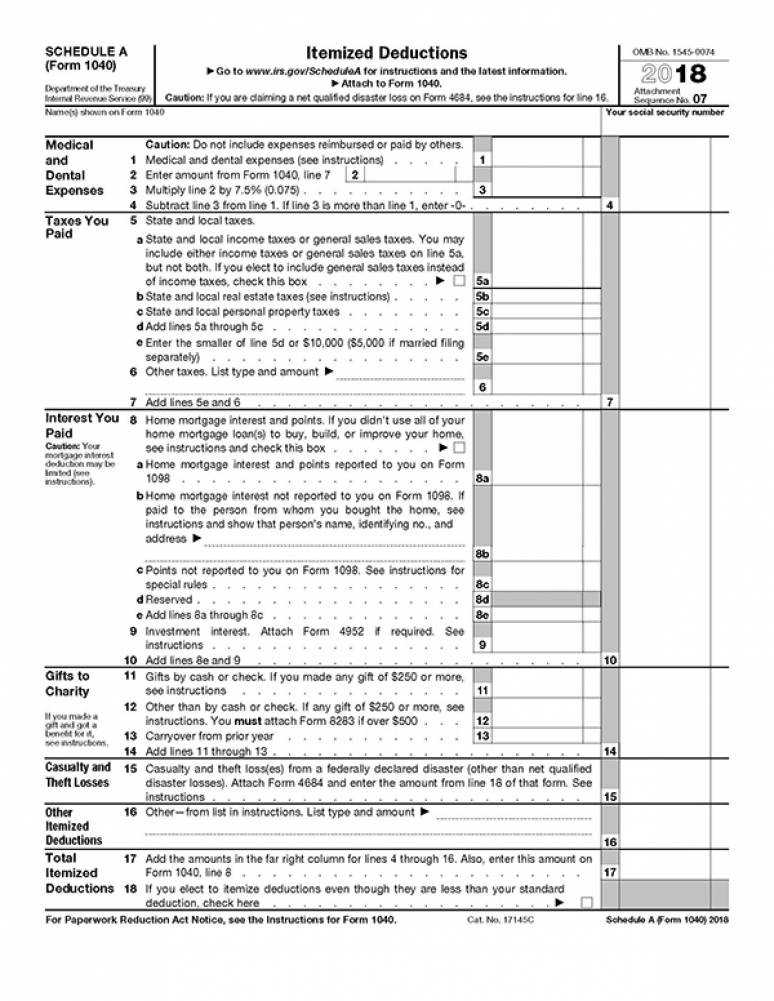

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

When Are You A Tax Resident In Malaysia Simple Explanation

2018 2019 Malaysian Tax Booklet

Don T Lose Your 2018 Tax Refund Forever 1 5 Billion Reasons To Act Now

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Malaysian Tax Issues For Expats Activpayroll

Different Types Of Income Tax Assessments Under The Income Tax Act

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

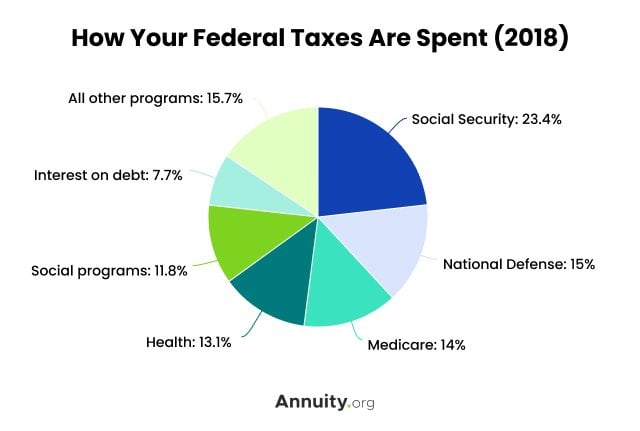

Tax Information What Are Taxes How Are They Used

Malaysia Payroll And Tax Activpayroll

What You Need To Know About Payroll In Malaysia

New Zealand 2020 21 Income Tax Year Taxing Wages 2021 Oecd Ilibrary

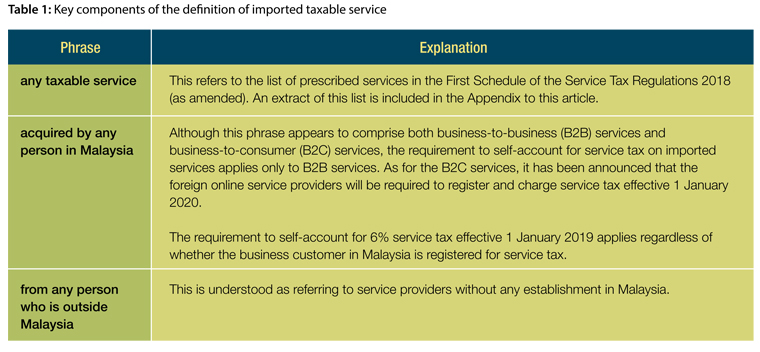

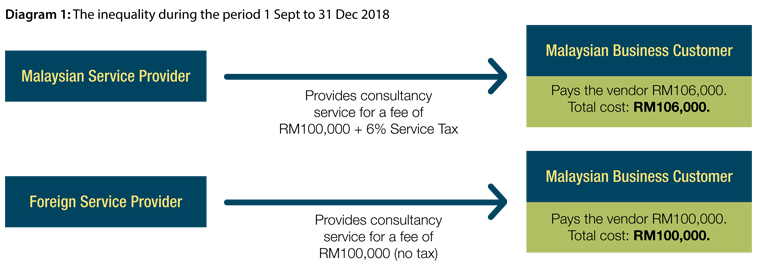

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Doing Business In The United States Federal Tax Issues Pwc

Your Federal Income Tax For Individuals Irs Publication 17 2021 U S Government Bookstore

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Malaysia Sst Sales And Service Tax A Complete Guide